1. Key Facts About Guyana: A Nation with Rich History and Promising Futurea

Context: The recent visit of the Indian Prime Minister to Guyana marks a historic moment, being the first visit by an Indian leader in over 50 years. This highlights the enduring ties between the two nations, driven by shared history and diaspora connections.

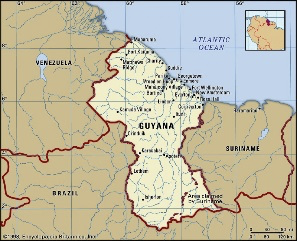

Geographical Overview:

- Location: Guyana is situated in the northeastern corner of South America.

- Borders:

- North: Atlantic Ocean

- East: Suriname (separated by the Courantyne River)

- South and Southwest: Brazil

- West: Venezuela

- Maritime Neighbors: Barbados and Trinidad and Tobago:

- Connection to the Caribbean: Despite its location in South America, Guyana shares strong cultural and historical ties to the Caribbean and is a founding member of the Caribbean Community (CARICOM).

Historical Insights:

- Indigenous Roots: The name “Guyana,” derived from the indigenous term “guiana”, means “land of water.”

- Colonial Legacy:

- Initially a Dutch colony in the 17th century.

- Became a British possession by 1815.

- Independence: Guyana gained independence from the UK in 1966 and has been a member of the Commonwealth since 1970.

- Colonial Disputes: The country is engaged in territorial disputes with Suriname and Venezuela, rooted in its colonial past.

- Language: It is the only English-speaking country in South America.

People and Culture:

- Population: The majority of Guyana’s people are of colonial origin:

- Descendants of African slaves and Indian indentured workers brought to work in the coastal sugarcane plantations.

- A smaller population of indigenous peoples resides in the forested interior.

- Capital: Georgetown serves as the capital and main port of Guyana.

Governance and Economy:

- Government: Unitary multiparty republic with a National Assembly as its legislative body.

- Currency: Guyanese Dollar (G$)

- Key Resources:

- Fertile agricultural lands

- Rich mineral reserves, including bauxite and gold

- Extensive tropical forests covering 80% of the country

- Recently discovered offshore oil and gas (O&G) reserves

Natural Features:

- Rivers:

- Essequibo River: The largest river in the country.

- Other key waterways: Berbice, Courantyne, and Demerara.

- Forests: Guyana’s tropical forests are a critical natural asset, supporting biodiversity and the economy.

Conclusion:

Guyana is a nation where colonial history meets a promising future. With its rich natural resources, strategic location, and cultural diversity, the country is poised for significant growth while remaining a vital partner in global and regional affairs.

2. Central Value Added Tax (CENVAT) Credit: Simplifying Taxation for Businesses

Context: The Supreme Court has recently provided a significant boost to telecom companies by allowing them to claim CENVAT credit for expenses incurred on the installation of mobile towers and peripherals, including prefabricated buildings (PFBs), for which they pay excise duties.

Understanding CENVAT Credit:

- Definition: CENVAT (Central Value Added Tax) allows manufacturers to offset the excise duty or additional duty paid on input services against the excise duty payable on their final product or output services.

- Purpose: It simplifies the tax process by eliminating double taxation and reduces the tax burden on manufacturers and consumers.

- Mechanism:

- Manufacturers can use the credit for taxes paid on raw materials during production.

- This ensures that tax is levied only on the value added at each stage of production, not repeatedly on the same components.

Key Features of CENVAT:

- Introduced as a Replacement for MODVAT:

- CENVAT was introduced to modify and enhance the functioning of the earlier Modified Value Added Tax (MODVAT).

- Stages of Taxation:

- Raw materials go through various production stages where duties are levied on value additions.

- CENVAT ensures credits are available to reduce the cumulative tax impact.

- Regulatory Framework:

- The government introduced the CENVAT Credit Rules in 2004, providing guidelines to implement CENVAT and extend tax credits to Indian manufacturers.

- Eligibility for CENVAT Credit:

- Excise Duty on Final Products: For manufacturers producing final goods.

- Service Tax on Output Services: For service providers handling both taxable and exempted services.

- Inputs and Capital Goods: Applicable if these goods are partially processed.

Benefits of CENVAT Credit:

- Reduced Tax Liability:

- Businesses can offset taxes paid on inputs, significantly lowering their overall tax burden.

- Encourages Investment:

- Tax credit on capital goods incentivizes businesses to invest in modernization, technological upgrades, and improved productivity and quality.

- Promotes Compliance:

- Companies can claim credits only if input suppliers pay taxes, encouraging a robust tax compliance culture.

Impact on Businesses:

- Cost Efficiency: CENVAT helps reduce production costs, benefiting both manufacturers and consumers.

- Encourages Growth: With reduced tax burdens and incentives for investments in capital goods, businesses are better positioned to expand and modernize.

- Simplified Taxation: The elimination of double taxation ensures a streamlined tax process, reducing administrative hassles for businesses.

Conclusion:

CENVAT Credit plays a pivotal role in fostering a business-friendly environment by simplifying the tax regime and promoting industrial growth. It not only reduces the financial strain on businesses but also incentivizes technological advancements and tax compliance, making it a vital component of India’s taxation system.

3. Easing Bail Norms for Undertrial Prisoners in India

Context: The Union Home Minister has recently stressed the need to release undertrial prisoners who have served over one-third of the maximum sentence for their alleged crimes before Constitution Day (November 26).

This initiative aligns with the newly introduced provisions under the Bharatiya Nagarik Suraksha Sanhita, 2023 (BNSS), which aims to revise bail norms and address issues of prolonged detention.

Key Features of Section 479 of BNSS:

About Section 479:

This provision revises bail norms to ensure timely release for undertrial prisoners, especially for first-time offenders.

General Bail Rules:

- Non-Capital Offences: Undertrials accused of offences not punishable by death or life imprisonment are eligible for bail if they have completed half of the maximum sentence for the crime.

- Builds on Section 436A of the CrPC, which also addressed prolonged detention.

Special Provisions for First-Time Offenders

- Eligibility: First-time offenders (individuals with no prior convictions) must be released on bond if they have served one-third of the maximum sentence for the alleged offence.

Exceptions

- These provisions do not apply to cases involving multiple offences or those under active investigation for other crimes.

Supreme Court’s Role in Implementing Section 479:

Retrospective Application

- In August 2024, the Supreme Court declared that Section 479 applies retrospectively, covering cases pending before the law took effect on July 1, 2024.

Implementation Measures

- Identification of Eligible Prisoners

- Jail authorities must identify eligible prisoners and report them to courts for their release.

- State and UT Compliance

- State Governments and Union Territories were directed to submit affidavits detailing undertrial eligibility and release status within two months.

Recent Developments:

- As of October 2024, only 19 of 36 states and UTs have complied with the Supreme Court’s orders.

- On November 19, the Court reiterated the importance of prioritizing women undertrials for bail eligibility.

India’s Unertrial Population:

- Overcrowded Prisons: India has one of the largest populations of undertrial prisoners, many of whom remain detained for years without conviction.

- Prolonged Detention: Many undertrials have already served significant portions of their potential sentences due to slow judicial processes.

Conclusion:

The provisions under Section 479 of the BNSS mark a crucial step in addressing the issue of prolonged detention among undertrials, emphasizing fairness and speedy justice. However, the success of these reforms depends on effective implementation by state authorities and strict compliance with Supreme Court directives.

This initiative is not just a matter of judicial efficiency but a critical step toward safeguarding human rights and upholding the principles of justice for all.

4. Nafithromycin: India’s First Indigenous Antibiotic

Context: India recently launched Nafithromycin, its first indigenous antibiotic, developed to combat the growing challenge of drug-resistant bacteria.

About Nafithromycin:

- Development

- Created with support from the Biotechnology Industry Research Assistance Council (BIRAC), under the Department of Biotechnology.

- Market Name

- Launched as “Miqnaf” by Wockhardt Pharmaceuticals.

- Target Condition

- Specifically designed to treat Community-Acquired Bacterial Pneumonia (CABP) caused by drug-resistant bacteria.

Features of Nafithromycin:

- Novel Antibiotic Class

- The first new antibiotic in its class to be developed globally in over 30 years.

- Enhanced Efficacy

- 10 times more effective than azithromycin.

- Comparable results achieved with just a three-day treatment regimen.

- Wide Pathogen Coverage

- Effective against typical and atypical bacteria.

- Overcomes existing drug resistance mechanisms.

- Safety and Convenience

- Minimal gastrointestinal side effects.

- No significant drug interactions.

- Unaffected by food, enhancing patient convenience and adherence.

Significance of Nafithromycin:

- Addressing Antimicrobial Resistance (AMR)

- Provides a solution to combat multi-drug-resistant pathogens.

- Tackles a critical global health challenge by reducing prolonged illnesses and high healthcare costs.

- Global Health Impact

- Pneumonia causes over two million deaths annually, with India accounting for 23% of the global burden.

- Nafithromycin offers hope for reducing mortality and alleviating strain on healthcare systems.

Conclusion:

Nafithromycin marks a milestone for India’s pharmaceutical innovation, addressing both national and global health crises while demonstrating the country’s commitment to tackling antimicrobial resistance and improving healthcare outcomes.

5. How PM Vidyalaxmi Stands Out Among Other Schemes

Context: The Union Cabinet recently approved the PM Vidyalaxmi Scheme, a Central Sector Scheme designed to provide financial support to meritorious students pursuing higher education in India.

About PM Vidyalaxmi Scheme:

- Objective

- Aimed at offering collateral-free and guarantor-free loans to meritorious students enrolling in higher education institutions ranked under the National Institutional Ranking Framework (NIRF).

- Coverage

- Focuses exclusively on NIRF-ranked institutions (around 860 institutions).

- Targets students from families with an annual income of up to 8 lakh, who are not beneficiaries of other government scholarships.

- Priority given to students from government institutions pursuing technical or professional courses.

- Loan Features

- Covers the entire tuition fee and other related expenses.

- Offers loans up to 10 lakh with a 3% interest subvention during the moratorium period for 1 lakh students annually.

How PM Vidyalaxmi Differs from Other Schemes:

- Broader Coverage

- Unlike earlier schemes focused on low-income groups, PM Vidyalaxmi extends financial support to middle-income families, irrespective of caste or background.

- Eligibility Criteria

- Previous schemes included institutions accredited by NAAC or NBA, covering around 20,000 institutions.

- PM Vidyalaxmi restricts eligibility to the top 100 NIRF-ranked institutions, ensuring funds are directed toward premier institutions.

- Streamlined Application Process

- A centralized Vidyalaxmi portal ensures a simplified and transparent loan application process, reducing bureaucratic hurdles and delays.

Why PM Vidyalaxmi Matters:

The scheme represents a paradigm shift by prioritizing merit over broader accessibility, focusing on premier institutions, and supporting middle-income families. Its streamlined approach ensures efficient financial support, aligning with the government’s vision of making quality education more accessible to deserving students.

6. Gautam Adani Indicted in US Bribery and Fraud Case

Context: In a significant development, US prosecutors have indicted Gautam Adani, the chairman of the Adani Group, along with his nephew Sagar Adani and six others in a $250 million bribery and fraud case. The charges include bribing Indian officials, misleading investors, and obstructing justice in relation to solar energy contracts.

Key Allegations Against Gautam Adani:

- Defendants Involved

- Gautam Adani – Chairman of the Adani Group

- Sagar Adani – Executive Director of Adani Green Energy Ltd

- Vneet Jaain – CEO of Adani Green Energy Ltd

- Other Defendants – Former executives of Azure Power and employees of a Canadian institutional investor.

- Bribery for Solar Contracts

- The group allegedly bribed Indian officials to secure solar power contracts from the Solar Energy Corporation of India (SECI), potentially generating $2 billion in profits over 20 years.

- Direct meetings between Gautam Adani and government officials were reported to advance the bribery scheme.

- Fraudulent Capital Raising

- The defendants are accused of misleading US investors and raising funds under false pretenses, all while concealing the bribery scheme.

- These actions were purportedly designed to raise billions from international investors.

- Obstruction of Justice

- The accused allegedly obstructed investigations into the bribery and fraud scheme, compounding the legal implications.

Legal Framework and the Adani Group’s Response:

- US Indictment Process

- An indictment formally charges individuals with crimes and allows them to prepare their defense. The case falls under US jurisdiction due to the involvement of US investors and markets.

- Adani Group’s Response

- The Adani Group has strongly denied all allegations, asserting that the charges are merely allegations and do not prove guilt.

- A spokesperson emphasized the group’s commitment to good governance and compliance with legal norms, while they are prepared to seek legal recourse.

Immediate Fallout of the Indictment:

- Financial Consequences

- In the wake of the indictment, the Adani Group canceled a $600 million bond offering intended for foreign currency loan repayment.

- Shares of Adani companies plummeted, with Adani Green Energy seeing an 18.76% drop and Adani Energy Solutions falling by 20%.

- Political Repercussions

- In India, the Congress Party has renewed its call for a Joint Parliamentary Committee (JPC) investigation into alleged Adani-related scandals.

- Congress leader Jairam Ramesh demanded the appointment of a credible SEBI chief to oversee investigations.

- International Impact

- The Kenyan President canceled a $736 million PPP deal with the Adani Group to construct power transmission lines, citing the US indictment as a key factor.

Conclusion: A Global Scrutiny of Corporate Malpractices

The indictment of Gautam Adani and his associates sends a strong signal about global efforts to hold corporations accountable for corruption, fraud, and regulatory violations. With serious financial and political fallout, the case underscores the increasing scrutiny of corporate practices in international markets, which may have long-term implications for the Adani Group and its global ventures.